- Sustainable Planet -

- 2mins -

- 313 views

Activist group ‘Follow This’ launches climate campaign against Big Oil backed by huge investors

Green share-holder activist movement Follow This gets the support of investors who represent $1.3tn in assets under management.

That is encouraging news for anyone who cares about the future and wants to see the world’s biggest contributors to climate change, the largest oil companies, change their ways. They should invest heavily in renewable, sustainable energy instead of oil and gas. Unfortunately, these companies have vast financial resources, vested interests, and a culture that resists change. Therefore, their investments in renewables are minimal compared to their continued investment in fossil fuels.

Man with a mission

Fortunately, there are activists like Mark Verbaal, the founder of Follow This. It is his mission to stop climate change, and his organisation believes the only way to do so is to ensure that the oil industry stops searching for more oil, drilling for oil, and instead invests all of its billions into renewables.

Mark van Baal, Founder Follow This

Mark van Baal, Founder Follow ThisBacked by $1.3 Trillion

Follow This’ strategy is to change oil companies from within – as shareholders. They unite responsible shareholders to push Big Oil to go green.

They recently announced they got the backing of six big investors with more than $1.3tn (that is $1.300.000.000.000) in assets under management.

“This new and significant commitment from some of the world’s most important investors takes our fight against climate breakdown to a new level. Our call for Paris-aligned targets has landed in the capital markets, in effect moving this crucial issue to centre stage for responsible institutional investors. We expect that more investors will follow their leading peers and vote for change at Big Oil.”

These investors include Edmond de Rothschild Asset Management (managing € 75 billion, co-filed-Shell), Degroof Petercam Asset Management (€ 51 billion, all resolutions), Achmea Investment Management (€ 175 billion, ExxonMobil) and Arjuna Capital ($400 million, Chevron and ExxonMobil).

Sponsored by these investors, Follow This will be filing climate resolutions in 2023 at Shell, BP, ExxonMobil, and Chevron. The resolutions request the oil majors to align their 2030 emissions reduction targets with the Paris Climate Agreement.

Scope 3 emissions

Okay, this may seem like boring information but it is important to understand the different scopes of emissions that are related to oil & gas companies. And it is scope 3 that matters most as this really is the elephant in the room:

- Scope 1 emissions refer to carbon dioxide (CO2) emissions that are released directly into the atmosphere as a result of an organization’s activities. These emissions come from sources that are owned or controlled by the organization, such as on-site fossil fuel combustion or fugitive emissions from equipment leaks.

- Scope 2 emissions refer to CO2 emissions that result from the consumption of purchased electricity, heat, or steam. These emissions are not released directly by the organization, but they are a result of the organization’s activities and are under its control.

- Scope 3 emissions refer to CO2 emissions that are a result of the organization’s activities, but they are not under the direct control of the organization. These emissions can come from a variety of sources, such as the use of the organization’s products or services, the transportation of goods, or the disposal of waste.

For the oil & gas majors, scope 3 accounts for about 95% of all emissions. Big oil is seriously working on reducing its scope 1 & 2 emissions. But they refuse to take responsibility.

Smoking

That is why in 2023, Follow This will narrow the resolutions to focus on Scope 3 by 2030, because large-scale reductions of emissions from fossil fuels in this critical decade are essential to avoid climate breakdown. As the IPCC has stated: “Without immediate and deep emissions reductions across all sectors, limiting global warming to 1.5°C is beyond reach.”

“The focus on Scope 3 by 2030 leaves the oil majors no wiggle room for smokescreens about ‘net zero emissions by 2050’ or reduction targets for operational emissions (Scope 1 and 2, around 5% of emissions).

– Mark van Baal

During a video interview that BrightVibes recorded in 2020, Mark used a striking metaphor for the refusal of oil majors to take responsibility for scope 3:

“I sometimes compare that with a tobacco firm that says, ‘all our employees quit smoking, but we keep on selling cigarettes.’ “

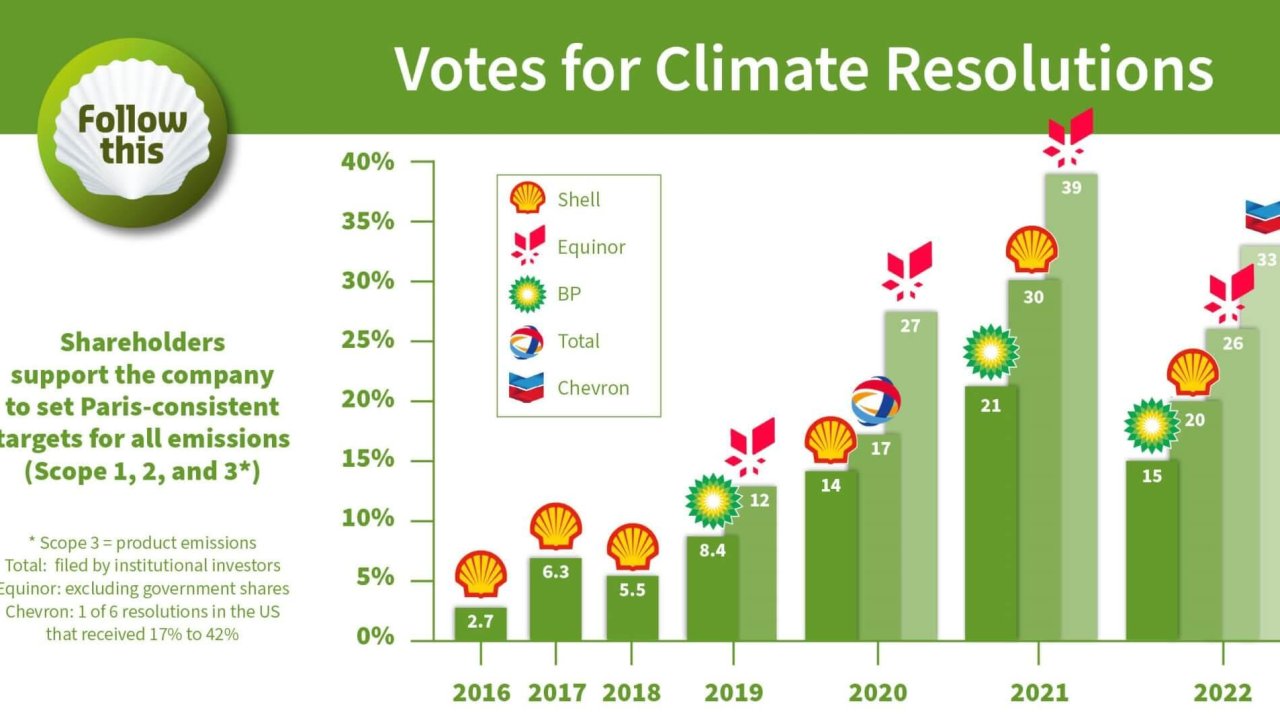

As the figure below shows, until 2022 Follow This saw its support amongst shareholders for its resolutions increase.

But this year, the support decreased substantially. However, this does not discourage Mark van Baal. In the Financial Times he stated that be thinks they can regain momentum and that there is no other way.

To learn more about Mark van Baal’s story, watch the inspiring interview we recorded with Mark back in 2022 here.